Trade Indices with an Award-Winning Broker

Apexforexmgt. provides exposure to the major global stock indices through index Contracts for Difference ("CFDs"), at competitive leverage on world-class trading platforms. Online CFD indices trading is a great way to participate in the top global stock markets. With Apexforexmgt., you can trade CFD indices futures from across the world at margins starting at just 1%. Trade AUS200 cash indices at AU$1 per point. Stay on top of overseas stock index movements with access to NASDAQ 100, S&P 500, EUREX, indices and more.

We’ve partnered with leading banking and non-banking financial institutions to ensure a deep liquidity pool, so that you get the best available market prices and ultra-low latency order execution.

What are the benefits of Indices trading?

- Trading CFD indices allows you to speculate on the direction of movement of the underlying index, without actually having physical ownership of any shares.

- When you trade indices you get to trade both bullish and bearish price moves, giving you greater trading opportunities.

- Competitive leverage means you can choose to increase your exposure with only a small investment from you.

- Remember, CFD indices are a leveraged product which mean that you can also magnify your losses.

- With powerful platforms like MT4, MT5 and Iress, Apexforexmgt. offers access to live streaming prices, cutting-edge technical analysis and charting tools.

What is the Best Platform to Trade Indices?

Discover the benefits of Indices trading on one of the most powerful trading platforms available, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Available across desktop and mobile platforms the MetaTrader 4 platform is ready when you are.

An Example of Indices CFD Trading

Suppose you want to trade CFDs, where the underlying asset is the US30, known as ‘’Dow Jones Industrial Average Index ” Let us suppose that the US30 is trading at:

You decide to buy 5 contracts of US30 because you think that the US30 price will rise in the future. Your margin rate is 1%. This means that you need to deposit 1% of the total position value into your margin account.

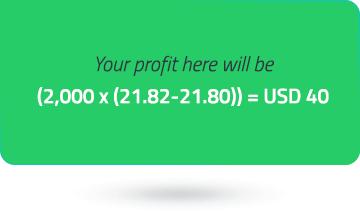

In the next hour, if the price moves to 22100.00/22112.00, you have a winning trade. You could close your position by selling at the current (bid) price of US30 which is 22100.00.

What is the Best Platform to Trade Indices?

In this case, the price moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In the loss scenario where your Free equity, (account balance + Profit/Loss) falls below the margin requirements (1105), the broker will issue a margin call. If you fail to deposit the money, and the market moves further against you, when your free equity reach the 50% of your initial margin the contract will be closed at the current market price, known as "stop out".

Notice how a small difference in price can offer opportunities to trade? This small difference is known as "pip" or "percentage in point". For Indices trading, 1 pip is equal to a price increment of 1.0 which is also called an Index point.